Understanding Child Support

By The DivorceLawyer.com Team

Divorce is hard. When there are children involved, this already arduous process becomes even more complicated. Parents have a legal obligation to support their children financially, regardless of whether or not they have custody. If you have children in the mix, it is important to understand child support and the factors that determine it.

Determining Child Support

Determining how much child support will be awarded requires the court to consider a myriad of factors. The courts aim to maintain a financial environment for your children that closely mirrors their accustomed standard of living before divorce. To achieve this, they generally look at the income of one or both parents.

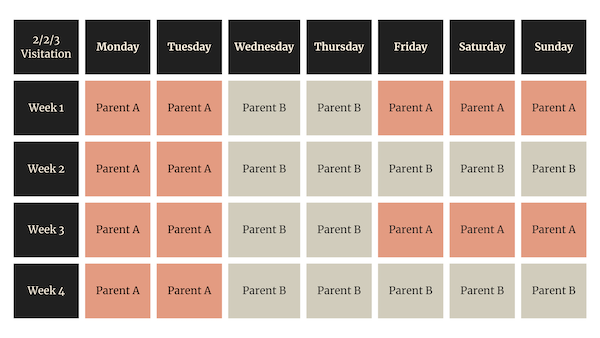

Circumstances vary from family to family. Health challenges, loss of income, special needs and how much time the non-custodial parent spends (and has spent previously) with children will all be considered when determining a child support arrangement. It’s also important to note that payment modifications can be made in the future.

Child support laws vary from state to state. Most states use one of three models to determine responsibility:

- Income Shares Model

- Percentage of Income Model

- Melson Model

Your new arrangement is about putting your child’s needs above all else, including how you feel about your ex-spouse.

Income Shares Model

Most states, including New York, Maine, Georgia, and Pennsylvania use the Income Shares Model to determine child support. This model takes the income of both parents into account and is based on the underlying principle that the financial state of children after the divorce should be as close as possible to the financial state they had before the divorce. It calculates child support by evaluating what proportion of income would have been spent on the children when the parents lived together, including a standard childcare obligation outlined by the state as well as extra expenses like child care, education, and special medical needs. The total amount spent on caring for children in the family is prorated to each parent based on their percentage of the combined income.

Percent Income Model

Some states use the Percent Income Model, which only considers the noncustodial parent’s income when determining child support. This model typically uses a standard rate per child based on the non-custodial parent’s income and makes adjustments up or down for special circumstances to calculate the child support amount due.

Melson Model

A handful of states use the Melson Model. This approach calculates child support by considering the income of both parents, similar to the Income Shares Model, but adds a component to ensure that each spouse’s basic needs are met in addition to those of the children to arrive at the final amount.

Tracking Expenditures

Parents facing divorce commonly want to know if the person receiving child support needs to track how they spend the money. In most states, they do not. Child support calculations take into account all of the things that children may indirectly or directly benefit from. In reality, child support often contributes to paying for a portion of the mortgage, utilities, or auto expenses that benefit everyone in the household, in addition to covering expenses that only benefit the child.

The only time that tracking expenses may be needed is when a request is made to increase child support. In this case, the court will likely want documentation showing that the amount granted is not adequate to provide for the children.

Types of Payments

When discussing child support, most people think about payments made to one parent by the other. Child support can include other types of payments that directly provide for the needs of the child. For example, a parent may directly cover medical insurance, school tuition, out-of-pocket costs, or extracurricular activities as part of their child support obligation.

Duration

Child support typically continues until a child graduates from high school, not to exceed 20 years of age. A few states require child support payments to be made until the child completes college.

Modifications After Divorce

Like custodial issues, the amount of child support can be modified after a divorce is final. Most states require that you show a change of financial circumstance or that the needs of the child have changed to modify existing child support obligations. Typically, a parent will file a request for a change when the income of the person who is paying child support significantly increases or decreases.

Non-Payment of Child Support

If you find yourself in a situation where your child’s other parent fails to pay child support, consult an attorney. You may need to take your ex-spouse back to court, file a complaint with law enforcement, or contact the Department of Human Services for additional support. Failure to pay child support can result in fines and jail time, in addition to making the payments.

It is important to note that the law considers child support separate from custody and visitation schedules. If your ex fails to pay child support, you cannot withhold visitation. Doing so may put your own custodial and visitation rights at risk. Though it can be frustrating, you should always go through the proper legal channels to have child support payments enforced if you run into challenges.

Sage Separations

The emotions that coincide with ending a marriage can make it difficult to compromise. When it comes to child support, it’s important to remember that your new arrangement is about putting your child’s needs above all else, including how you feel about your ex-spouse. Whether you are the custodial parent or the parent paying child support, each comes with its own challenges. Keeping the proceedings as fair and diplomatic as possible will help make things better for everyone involved.

Stay in the Know

Discover Related Articles

Get Informed. Get Empowered

Read up on essential divorce topics to learn more about the process and all its different aspects.

Introductions, no pressure

Connect with a Top Divorce Attorney

in Columbus, OH

Go to Columbus, OH page

Are you in a different location? We can introduce you to the best family lawyers in your area